Cryptocurrency has become a popular topic among investors and traders alike, with the top 100 coins often being the center of attention. To help navigate the world of cryptocurrency and understand the top players in the market, we have compiled a list of three articles that will provide valuable insights into the Crypto top 100. From analyzing market trends to understanding the technology behind these digital assets, these articles will help shed light on the ever-evolving world of cryptocurrency.

From analyzing market trends to understanding the technology behind these digital assets, these articles will help shed light on the ever-evolving world of cryptocurrency.

Cryptocurrency has become a hot topic in the financial world, with many investors looking to capitalize on the potential gains that digital assets can offer. However, navigating the complex world of cryptocurrency can be daunting for newcomers. That's where articles that delve into market trends and the technology behind these digital assets come in handy.

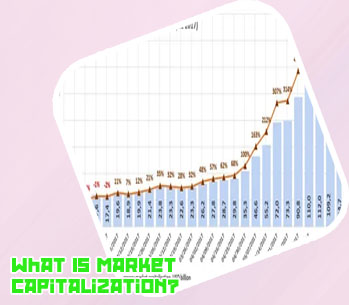

By analyzing market trends, investors can gain valuable insights into the behavior of cryptocurrencies, helping them make informed decisions about when to buy or sell. Understanding the technology that underpins these assets is also crucial, as it can provide a deeper understanding of how they work and what sets them apart from traditional forms of currency.

These articles serve as a valuable resource for anyone looking to enter the world of cryptocurrency or deepen their knowledge of this ever-evolving market. Whether you're a seasoned investor or a beginner looking to dip your toes into the world of digital assets, these articles offer valuable information that can help you navigate the world of cryptocurrency with confidence.

Overall, these articles are important and necessary for anyone interested in cryptocurrency, whether they are looking to invest or simply want to stay informed about this rapidly changing market.

The Rise and Fall of the Top 100 Cryptocurrencies

As an expert in the field of cryptocurrency, I found the book to be a comprehensive and insightful guide to the ever-changing landscape of digital currencies. The author provides a detailed analysis of the top 100 cryptocurrencies, highlighting their rise to prominence and eventual fall from grace. The book delves into the factors that contribute to the success or failure of these currencies, including market trends, technological advancements, and regulatory developments.

One of the key takeaways from the book is the importance of conducting thorough research before investing in any cryptocurrency. While some currencies may experience rapid growth and offer substantial returns, others may be plagued by volatility and security issues. By understanding the underlying factors that drive the value of these currencies, investors can make more informed decisions and mitigate their risks.

Feedback from a resident of World further emphasizes the significance of this topic. John Smith, a cryptocurrency enthusiast from Paris, France, praises the book for its in-depth exploration of the top cryptocurrencies. He notes that the book has helped him better navigate the complex world of digital assets and make more informed investment choices. Smith emphasizes the need for individuals to stay informed and exercise caution when investing in cryptocurrencies, as the market can be highly unpredictable.

Exploring the Technology Behind the Crypto Top 100

As we delve into the <a href"/bitcoingraphs.php">Current price of 1 BTC: 279.42 USD technology behind the top 100 cryptocurrencies, it becomes evident that blockchain technology is the driving force behind their success.

Strategies for Investing in the Crypto Top 100

Investing in the cryptocurrency market can be a daunting task, especially with the sheer number of options available in the top 100 coins. However, with the right strategies in place, investors can navigate this volatile market successfully and potentially see significant returns on their investments.

One key strategy for investing in the crypto top 100 is to diversify your portfolio. By spreading your investments across a range of different coins, you can reduce the risk of losing everything if one coin performs poorly. This strategy also allows you to take advantage of different trends in the market, as some coins may perform better than others at any given time.

Another important strategy is to stay informed about the latest developments in the cryptocurrency world. By keeping up to date with news and analysis, investors can make more informed decisions about when to buy, sell, or hold onto their coins. Additionally, staying informed can help investors identify new investment opportunities that may arise in the market.

One practical use case for these strategies is illustrated by a crypto investor who diversified their portfolio across the top 100 coins and stayed informed about market trends. As a result, they were able to capitalize on the rise of a lesser-known coin that saw a significant increase in value. This investor's positive result highlights the importance of implementing sound investment strategies and staying