When it comes to understanding the cost of Etherium, it's important to stay informed and up to date on the latest trends and developments in the cryptocurrency market. Two articles that can provide valuable insights into Etherium cost are "Exploring the Factors Influencing Etherium Price Fluctuations" and "Strategies for Investing in Etherium: Tips for Maximizing Returns." These articles delve into the various factors that can impact the price of Etherium and offer practical advice for investors looking to navigate the volatile cryptocurrency market.

Exploring the Factors Influencing Etherium Price Fluctuations

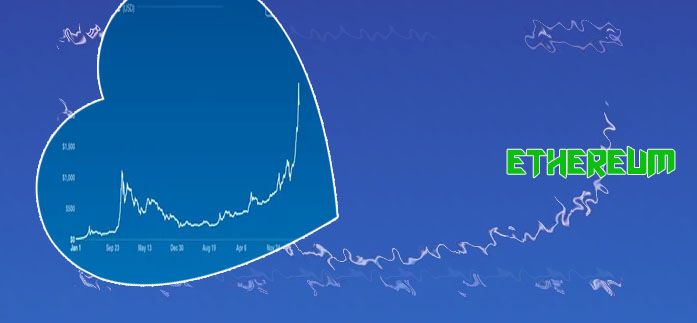

Cryptocurrency enthusiasts and investors around the world have been closely monitoring the price fluctuations of Ethereum, one of the most popular digital currencies in the market. Understanding the factors that influence these price changes is crucial for making informed decisions when trading or investing in Ethereum.

One key factor that influences Ethereum price fluctuations is market demand. Just like any other asset, the price of Ethereum is determined by the laws of supply and demand. When there is a high demand for Ethereum, the price tends to increase, and vice versa. Factors such as increased adoption, mainstream acceptance, and regulatory developments can all contribute to a rise in demand for Ethereum.

Another factor that can affect Ethereum's price is technological advancements and upgrades. Ethereum is a platform that allows developers to build decentralized applications (dApps) on its blockchain. Any upgrades or improvements to the Ethereum network can impact its price. For example, the implementation of Ethereum Improvement Proposals (EIPs) can enhance the functionality and security of the network, leading to a potential increase in price.

Market sentiment is also a significant factor in Ethereum price fluctuations. News, events, and social media trends can all influence how investors perceive Ethereum's value. Positive news such as partnerships with major companies or successful network upgrades can boost investor confidence and drive up the price of

Strategies for Investing in Etherium: Tips for Maximizing Returns

In recent years, the cryptocurrency market has experienced significant growth, with many investors looking to capitalize on the potential returns. One of the most popular cryptocurrencies, Ethereum, has garnered a lot of attention due to its innovative technology and potential for high returns. However, investing in Ethereum can be complex and risky, requiring careful planning and strategy.

One key strategy for investing in Ethereum is to diversify your portfolio. By spreading your investments across different cryptocurrencies, you can reduce the risk of losing all your funds if one particular asset performs poorly. Additionally, it is important to stay informed about the latest developments in the Ethereum ecosystem, as new updates and partnerships can have a significant impact on the price of the cryptocurrency.

Another important strategy is to set clear investment goals and timelines. Whether you are looking to make a quick profit or hold onto your Ethereum for the long term, having a clear plan in place can help you make informed decisions and avoid emotional trading.

Furthermore, it is crucial to conduct thorough research before making any investment decisions. By analyzing market trends, studying the technology behind Ethereum, and monitoring the behavior of other investors, you can make more informed choices and increase your chances of maximizing returns.