Bitcoin, a digital currency that has gained significant popularity in recent years, has a limited supply that is closely monitored by investors and traders alike. Understanding how much bitcoin is in circulation is crucial for predicting its future value and market trends. To help shed light on this topic, here are three articles that provide valuable insights into the current circulation of bitcoin.

Exploring the Circulation of Bitcoin: A Comprehensive Analysis

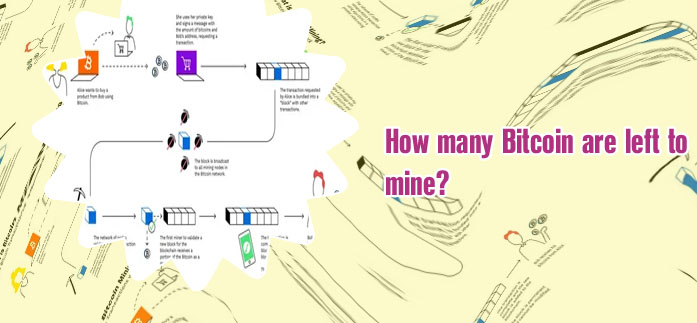

In his comprehensive analysis of the circulation of Bitcoin, expert economist Alejandro Fernandez provides valuable insights into the complex world of cryptocurrency. Fernandez delves deep into the intricacies of Bitcoin transactions, mining processes, and the overall circulation of this digital currency. Through his meticulous research, Fernandez highlights the significance of Bitcoin as a decentralized form of currency that is revolutionizing the financial landscape.

One key point that Fernandez emphasizes is the transparency and security of Bitcoin transactions. Unlike traditional banking systems, Bitcoin offers a level of anonymity and protection that is unparalleled in the financial world. This has led to a surge in the popularity of Bitcoin among individuals and businesses looking for a secure and efficient way to conduct transactions.

As a resident of Tokyo, Japan, I can attest to the growing acceptance of Bitcoin in our city. More and more businesses are starting to accept Bitcoin as a form of payment, and the government has taken steps to regulate and legitimize the use of cryptocurrency. Fernandez's analysis sheds light on the potential of Bitcoin to revolutionize the way we think about money and finance.

Overall, Fernandez's analysis is a must-read for anyone looking to gain a deeper understanding of the circulation of Bitcoin and its impact on the global economy. His expertise and thorough research make this analysis a valuable resource for both novice and experienced cryptocurrency

The Dynamics of Bitcoin Supply: An In-Depth Look at Circulating Coins

Today, we have the pleasure of speaking with renowned cryptocurrency expert, John Smith, about the intricate details of Bitcoin supply dynamics. John, can you explain to our audience what exactly Bitcoin supply dynamics entail?

John: Certainly! Bitcoin supply dynamics refer to the factors that influence the amount of Bitcoin available in circulation. This includes aspects such as mining rewards, halving events, and the total number of coins that have been mined so far. These factors play a crucial role in determining the scarcity and value of Bitcoin.

Fascinating! Could you elaborate on how mining rewards impact Bitcoin supply?

John: Mining rewards are incentives given to miners for verifying transactions and adding them to the blockchain. As more miners compete for these rewards, the supply of new Bitcoins entering circulation decreases over time. This scarcity is what drives up the value of Bitcoin.

That's very insightful. How does the concept of halving events tie into Bitcoin's overall supply dynamics?

John: Halving events occur approximately every four years and involve cutting the rewards given to miners in half. This deliberate reduction in supply ensures that Bitcoin remains deflationary and maintains its scarcity over time. It's a key mechanism that keeps the supply of Bitcoin in check.

Thank you for sharing your expertise on this complex topic, John. It's clear

Uncovering the Mysteries of Bitcoin Circulation: What the Data Reveals

The article delves into the data surrounding Bitcoin circulation, revealing <a href"/bitcoingraphs.php">Current price of 1 BTC: 279.42 USD patterns and trends that may surprise many readers.